In the shipping industry, low pricing and wide service coverage are two important elements that carriers must offer to make their business profitable. Alliances are multiyear vessel-sharing agreements approved by regulators that allow carrier members to offer joint services and cooperate on capacity management to increase their customer base globally and offer low prices.

Alphaliner’s latest report shows that the major container shipping alliances comprises the world’s top nine liner operators control just 39% of the global box shipping fleet, far below the 80% they previously had.

The consultancy’s latest count shows that the capacity operated by the 2M, THE and Ocean alliances fell to a three-year low in January.

Alphaliner said, “Despite frequent claims the alliances control 80% of the container fleet, an Alphaliner survey shows the nine carriers that form the three major alliances operate the majority of their capacity outside their alliance agreements. The actual amount of capacity operated under ‘alliance services’ is equivalent to a steady 38%-41% of the total fleet based on data from the last five years.”

Alliance service concentration rises on specific routes, particularly long-haul trades that need large tonnage and a minimum number of ships in order to ensure sufficient rotations.

Some 94% of capacity on the Far East – Europe (North Europe and Mediterranean) trade is currently operated under alliance services. This constitutes the longest of the major east-west routes, and presents the highest barrier to entry for new carriers, with services requiring at least 10 ships of at least 13,000 TEU to stay competitive.

On the transpacific, alliance services represent 81% of total capacity.

On the shorter transatlantic route, where fewer ships are needed to maintain service rotation, alliance services represent just 47% of total capacity.

Transpacific and transatlantic alliance shares have partly fallen because MSC, which will end its alliance with Maersk in 2025, is increasingly going solo.

Alphaliner believes MSC will go it alone and does not need to join another alliance, given its massive orderbook and unprecedented buying spree in the secondhand market.

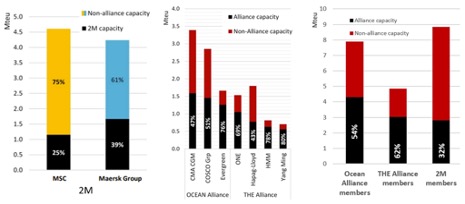

Having dethroned Maersk at the top of the liner rankings in early 2022, MSC now operates 75% of its global capacity outside the 2M alliance – the highest proportion of the nine alliance carriers.

The Ocean Alliance’s members are individually smaller than Maersk and MSC, but they deploy much more of their capacity within the alliance. CMA CGM, Cosco have around half their capacity in the Ocean Alliance and Evergreen at three-quarters. Ocean’s capacity of 4.3 million TEUs accounts for 16% of global fleet capacity while 2M capacity is 2.82 million TEUs which is only 11% of global capacity, a much lower share than the overall combined MSC-Maersk fleets (34%).

Besides, the members of THE Alliance also contribute a lot of their fleets to the strategic agreement. Yang Ming has 80% of its capacity in alliance services, HMM 78%, ONE 69% and Hapag-Lloyd 43%, according to Alphaliner. The combined deployed capacity in THE Alliance, 3.03 million TEUs, represents 12% of global capacity.

Report by ALEX @WEDO 2023-06-13