The export side in China is trending down, along with the demand for aircraft carriers is not much in a short period, mainly due to the number of inventories in Europe and the US that have been consumed. end. But with the long-term and long-term negative effects, some businesses in China have become reluctant to start working out of China.

A short survey of European companies still active in China created by the EU Chamber of Commerce (EUCCC) should say, “Companies remain committed to China overall but in the face of political Covid books due to the epidemic raging again in the country and the recent conflict in Ukraine have shown some pause in activity to think twice.

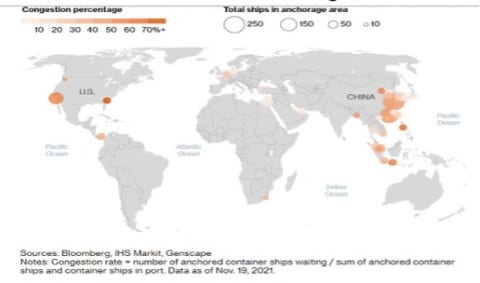

Zero Covid policy clogs sea traffic, halts logistics activities (cre: vinare)

The EUCCC also issued a warning based on a survey earlier this year: “Some people could leave if the waves of uncertainty continue as they are, especially as different schools plan different projects. more judgmental”.

Some business consultants are scrutinizing plans to shift planned investments out of the country as policy-aligning firms are ahead of them, the most in a decade, and fold Duplicate companies into the year 2021.

“The war in Ukraine also affects investor confidence, 7% are currently considering moving their current or possible investment jobs out of China. 33%, think the school becomes less attractive as a destination for future investment due to the tension of attracting many opinions in the boardroom”.

With the market being escalated by the stressors, and the Chinese export market suffering the effects, let’s make a difference among ship operators as the pandemic shifts trade.

HSBC’s weekly report has identified a segment in the container shipping market between spot and contract operators, noting an increase in Pacific spot market players rapidly depleting, as defined by Alphaliner.

HSBC free fall field examples with skydivers from the weekly review. The Shanghai Containerized Cargo Index (SCFI) reported a 9.7% week-on-week decline and a 37% year-to-date recovery, while the Ningbo Container Freight Index (NCFI) back reported a decrease of only 11.6% weekly. According to the NCFI, the US West Coast Day to Day Rate fell 15.8% while the East Coast Rate fell slightly at 9%, while the Ningbo Transportation Exchange noted that volumes remained “insufficient.”

But from a different perspective, the skydiver will follow the path to Earth first. According to HSBC, rates are expected to drop by 58% in 2023, with the last bits of action before bottoming out in 2024, with a 37% drop in the spot market.

The incomes of players more varied route range and a relatively higher signing rate (cre: U&I Logistics)

Only the West Coast Japan transaction recorded an upward movement, only 0.37% from the previous week of trading. All other translations are on a downtrend, losing 21% in value in just a week to the West Coast index.

HSBC also continues to warn: “Carriers on the trans-Pacific and, more importantly, freight rates are likely to be most affected by the changing tides. But left, a center of the players is the range of the line back to more multiform and the rate of the same association for the can be against the variable of the same. CCFI also showed a slight decrease of 2.5% from last week thanks to the impact of the higher interest rate system, 4% higher than the same period from Q3 2022 so far. “

Reported by Lucy 2022-09-27