The supply chain situation in Shanghai continues to worsen. Cargo backlogs in Shanghai are a signal of global port congestion as the Covid-19 crisis drags on.

The Yangshan Container Terminal in Shanghai. Import cargo is piling up with shuttle trucks restricted from pick-ups by a strict COVID lockdown.

China’s largest Covid-19 outbreak in two years continues to spread in spite of extended city lockdowns in China. The concern is growing because the situation in China will have immense downstream effects on global supply chains that could dwarf previous disruptions since the start of the pandemic.

Last May, the big Yantian container terminal at the Port of Shenzhen cut down to 30% of normal productivity for a month to put down a handful of positive cases there. Hundreds of thousands of shipments that couldn’t call the port accumulated in plants and warehouses, and many container ships omitted the port to avoid waiting seven days or more at anchor. It took weeks after the port reopened to clear the cargo backlog. The effects cascaded to the United States and Europe, resulting in port congestions, transit times triple the norm, and missed retail deliveries for the holidays.

The difference this time is that an entire metropolis — and highly interconnected global trade center — is essentially halted. Not since the initial 2020 COVID-19 outbreak in Wuhan have lockdowns been this extensive in China.

“It’s probably worse than Wuhan,” said Jon Monroe, an sea shipping and supply chain expert who leads a consulting company. “You’re going to have a lot of pent-up orders. It’s going to be an overwhelming movement of goods” that will drown shipping companies and ports until the lockdowns are lifted.

Freight Is Piling Up

Shanghai’s 25 million people are almost all under some form for 18 days. The Chinese government this week slightly eased the restrictions, dividing the city into three categories based on previous screenings and risk levels. Residents can wander outside their apartment buildings but are encouraged to stay home in neighborhoods with no positive COVID-19 cases in the past two weeks. Those in high-risk locations must still shelter at home.

Spanish financial services firm BBVA predicts the Chinese government will be determined with the “zero-COVID” strategy and lockdowns until at least June. Other China observers stated it could take even longer to meet China’s infection standard.

Shanghai stands as of the biggest manufacturing centers and financial hubs in China, with heavy concentrations of automotive and electronics suppliers. It is home to the largest container port in the world and a major airport serving inbound and outbound air cargo. Exports produced in Shanghai account for 7.2% of China’s total volume and about 20% of China’s export container throughput moves through the port there, according to the BBVA report.

Most warehouses and plants are stopped, nine out of ten trucks are sidelined, the port and airport have limited function, shipping units are left in the wrong places, and freight is piling up.

More and more, the logistics impacts are rippling beyond the contagion epicenter.

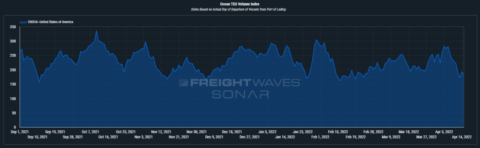

A chart from the FreightWaves SONAR database shows a significant downturn in ocean export volume from Shanghai to the U.S. this month.

Impacts Spread Beyond Shanghai

Export containers that were already at the Port of Shanghai when the lockdown started are making it loaden on vessels, but most cargo booked on outbound ships are accumulated at warehouses because shuttle trucks can’t make pickups or deliveries.

Truckers are required special permits, which are only valid for 24 hours, as well as negative COVID tests to get in and out of the city or enter certain areas, according to logistics services providers. Checking COVID certificates has led to huge traffic jams at the port.

The French logistics services provider Geodis revealed that truck drivers in the Shanghai zone are being obligated to wait up to 40 hours at certain highway entrances. Trucking rates have skyrocketed due to the limited supply, and exporters are waiting three to five days for cargo to get picked up, according to San Francisco-based Flexport.

Decreased manufacturing output, along with limited truck access to the Port of Shanghai and airport, is resulting in a significant drop in air and sea export volumes. Less demand is spelling out lower freight rates.

In response to the lack of labor and cargo, air carriers have announced widespread cancellations, and some sea shipping lines are omitting Shanghai port calls.

Several shipping lines have also started offloading refrigerated containers at other ports along their voyage as the storage area with electric plugs is too crowded in Shanghai. The port is running out of capacity for some types of cargo because importers cannot pick up their goods. As a result, customers face extra port charges and delays routing the cargo to its intended destination. A.P Moller-Maersk, the second-largest box ship operator, reported Thursday that it has stopped accepting bookings to Shanghai for refrigerated cargo, some types of gas, and flammable liquids.

More omissions are about to happen and liner firms may temporarily idle ships or cancel some outbound Asia sailings altogether, according to Crane Worldwide Logistics and other logistics service providers.

Asia-U.S. East Coast rates have a drop of 7% since the outbreaks in March, said freight booking site Freightos, which also publishes an ocean rate index.

“But even if the lockdown persists and demand drops significantly, ocean carriers will likely reduce capacity which could keep rates from plummeting, just as they were able to do in the first few months of the pandemic when ocean volumes fell significantly but transpacific rates declined by less than 15% and were about a level year on year,” Freightos indicated.

Now the global supply chain is backing up like water behind a dam. When water is released, the landscape gets flooded.

At Shanghai Pudong airport, ground handling firms are operating with a skeleton staff.

Shanghai Eastern Airlines Logistics, a cargo terminal operator, ceased bulk loading of containers after a positive COVID case, which will further slow cargo processing, said Dimerco, a Taiwan-based freight forwarder. Airlines report that Pactl, which operates three other cargo terminals, has halted the acceptance of dangerous goods and temperature-controlled cargo because the warehouse is full.

Flexport shared in a market update that 80% of commercial freighter services have been canceled and airlines are considering shifting operations to nearby airports. Qatar Airways published that freighter flights will remain canceled until next Thursday, saying “the latest COVID-19 restrictions announced by local authorities limit our ability to operate flights in and out of Shanghai with sufficient cargo loads.”

In response to the complicated situation, freight forwarders have been rerouting cargo to alternative airports such as Zhengzhou, Xiamen, Shenzhen, and Beijing, or the Port of Ningbo, but those facilities are beginning to feel congestion effects themselves. Rates to ship from those locations are also soaring.

Flights at Zhengzhou Xinzheng International Airport have decreased by 50%, according to Geodis. Most inbound cargo there is transit cargo to other places, such as Shanghai — which is compounding backlogs because the cargo is not allowed to move to its final destination. That means the logistics corps can only clear shipments that customers can pick up in Zhengzhou.

Dimerco warns that Zhengzhou airport is not accepting loose cargo but only palletized shipments due to the lack of labor. And the airport has just implemented a 14-day closed-loop program in which workers live on-site to minimize the potential for virus transmission, forcing the logistics service provider to pivot again and reroute shipments to other airports, including back to Hongqiao International, the second airport in Shanghai.

Everstream Analytics, which aids firms to manage their supply chain risk, predicts the U.S. and Canadian automotive assembly factories will quickly face delays and disruptions because the lockdowns will affect the delivery of parts such as seats, tires, engines, bodies, and brakes.

Vessels Queued at Port of Hong Kong and Yantian

Sailing schedules in South China are being disturbed by irregular feeder vessels and large barge services, causing delays for transoceanic ships at the ports of Hong Kong and Yantian, according to a situational update from the supply chain data platform project44. Both ports have been dealing with disruptive COVID restrictions for months.

Nearby manufacturing hubs in Vietnam and Cambodia are already suffering from a shortage of Chinese components for their manufacturing industries, project44 announced. And pharmaceuticals firms in India, which import 70% of their active ingredients from China, are coping with limited supplies.

FreightWaves SONAR data from project44 indicates that import containers in Shanghai waiting about a week to be cleared. The dwell time has raised since a citywide quarantine went into effect in late March.

Ocean shipping delays from the top three Chinese ports to Hamburg, Germany, and Amsterdam had already doubled to more than 12 days during the first quarter, before the Shanghai lockdown fully materialized, according to project44 data.

Sea freight expert Lars Jensen, CEO of Vespucci Maritime, summarized the situation on his LinkedIn page: “Until this situation is resolved — which appears next to impossible when matching the omicron variant with zero-tolerance — we should expect drops in export demand, port omissions and more blank sailings in the near term future as well as Shanghai-bound cargo increasingly being discharged elsewhere.”

COVID Lockdowns Spread

Whilst, COVID infections are escalating beyond Shanghai, according to news reports and logistics firms. The southern manufacturing hub of Guangzhou, for instance, has begun mass COVID testing, introduced travel restrictions, and changed schools to online learning — steps that often portend a wider lockdown.

The city of Kunshan — a crucial production center for electronics near Shanghai — is shut down until April 19. Part of Taicang, another manufacturing zone in Jiangsu province, is also suspended. A new wave of new COVID cases is hitting the coastal places of Dalian and Tianjin in the north, Ningbo in the east, and Xiamen and Dongguan in the south.

Ningbo officials obligated residents in two downtown districts to stay at home but so far the seaport is not affected. Nantong is on a partial lockdown until April 15. Port operations have been seriously impacted, with logistics companies rerouting shipments to Nanjing. Zhangjiagang is also under partial lockdown until April 19, resulting in slower port operations and some factory closures.

FreightWaves SONAR data indicates that ocean shipping lines rejecting more than 34% of container (TEU) bookings from Shanghai to the U.S. up from 12% on March 15. Rejections for China overall are about 20%, showing capacity is much tighter in Shanghai. Lower capacity will likely put pressure on sea freight rates once throughput picks up.

Many shippers are exercising contingency plans and using alternative import/export gateways when possible, but road transport is increasingly difficult.

The outbreaks have led to a virtual prohibition by the government on truck drivers from high- and medium-risk zones transporting cargo to low-risk zones. That includes shipping cargo from Shanghai and Kunshan to the Port of Ningbo. No cargo will be accepted if drivers have been to medium- or high-risk areas within the last 14 days or the factory is located in medium- or high-risk areas, stated UPS Supply Chain Solutions in a customer update.

As of 16 April, Dalian, Tianjin, parts of Beijing, Shanghai, and Dongguan are all in high- and medium-risk locations.

Dimerco said in an announcement that traffic control for road transportation is getting more strict and it is difficult to secure trucks to carry freight to Shanghai or alternative ports.

Lockdowns Ease U.S. Supply Chain Strains Before The Flood Of Cargo

The gridlock in China exports should bring temporary relief to congestion-plagued U.S. ports on both coasts, as well as in Europe, but logistics experts describe the breather is likely to be followed by a tsunami of deferred cargo once the lockdowns are lifted. The cargo volume will far exceed the handling capability of the ports, with containers jamming up terminals faster than they can be moved to inland transport and pushing ships into long queues at sea.

Delta Air Lines (NYSE: DAL) President Glen Hauenstein shared on an earnings call on 13 April that once the Shanghai restrictions are lifted, the airline expects a boom in cargo bookings that more than offsets the current export lag.

A mass lockdown that lasts until June could mean the drawdown of backlogged air and sea freight pushes into the peak season, as more volume enters the system.

“Even with air and ocean ports open, the length of the shutdown could make this iteration the most significant logistics disruption since the start of the pandemic,” Freightos published in its update.

Source: Freight Waves