Reported by Kylie 2023-06-20.

After a week with quite a lot of fluctuations in the supply chain and transportation sector, we have synthesized and selected the highlights below that you need to know in the past week from reputable sources

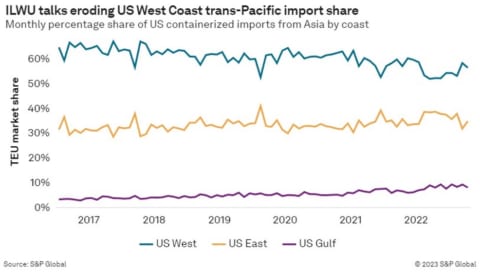

- Last Friday, West Coast ports face labor crisis over wages

Dockworkers and terminal operators at several West Coast ports are locked in a bitter contract dispute over pay and working conditions. The workers’ union and the employers’ group have been in talks for over a year, but have not reached an agreement.

The employers’ group accused the workers’ union of disrupting cargo operations at some major ports, including Seattle, Oakland, and Long Beach. The workers’ union denied the claim and said the workers were protesting.

The retail industry urged both sides to finalize a new contract as soon as possible. The ports are vital for the retail supply chain and handle almost 40% of U.S. imports.

- Vineyard Wind project receives first turbine components

The port of New Bedford in Massachusetts has received the first shipment of turbine components for the Vineyard Wind offshore wind project. The components were delivered by the UHL Felicity, a multipurpose heavy-lift vessel operated by Hamburg-based carrier UHL. UHL will be transporting Vineyard Wind towers and nacelles from France and Portugal for the next 12 months.

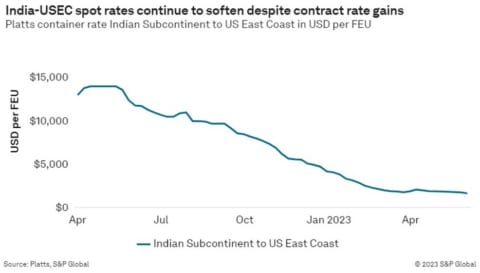

- Indian shippers face peak season surcharges to US

CMA CGM has announced peak season surcharges for all shipments from India to the US East and Gulf coasts from June 17. The surcharges are in addition to the general rate increases already in effect. The French liner said the surcharges are part of its efforts to provide reliable and efficient services to its customers.

- LCL demand grows as shippers adjust to market conditions

Less-than-container load (LCL) shipments are gaining popularity among shippers who want to avoid overstocking their inventories and save on ocean freight costs. Forwarders such as AIT Worldwide Logistics and Rhenus Logistics have reported a significant increase in LCL shipments year over year, especially from Southeast Asia and India. LCL shipments allow shippers to ship smaller and less frequent orders that match the current market demand.

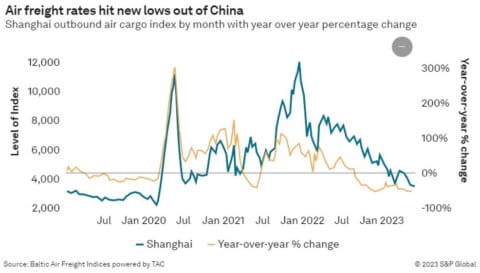

- Air Freight

– Air freight demand continued to recover from the pandemic-induced slump, reaching 12% above pre-crisis levels in April 2023, according to the International Air Transport Association (IATA).

– However, capacity constraints and rising costs remained a challenge for shippers and carriers, as air cargo rates increased by 7.5% month-on-month in May 2023, according to WorldACD.

– Some of the factors driving the demand for air freight include the e-commerce boom, the vaccine distribution, and the semiconductor shortage that affected various industries.

– For the week ahead, air freight shippers and carriers should monitor the COVID-19 situation in key markets such as India, Brazil, and Europe, as well as the geopolitical tensions between China and the U.S. that could affect trade flows.

- Sea Freight

– Sea freight also experienced strong demand and tight capacity, as global container volumes increased by 10.3% year-on-year in April 2023, according to Container Trade Statistics (CTS).

– The surge in demand led to port congestion, equipment shortages, and service disruptions, especially in major hubs such as Los Angeles/Long Beach, Rotterdam, and Shanghai.

– As a result, sea freight rates reached record highs, with the Drewry World Container Index reaching $6,257 per 40-foot container on June 10, 2023, up by 302% year-on-year.

– For the week ahead, sea freight shippers and carriers should prepare for possible delays and disruptions due to the labor dispute at West Coast ports that could affect up to 40% of U.S. imports from Asia. The dispute involves dockworkers who are demanding better wages and working conditions from terminal operators.

- Inland

– Inland transportation also faced capacity crunches and rising costs, as trucking and rail services struggled to keep up with the demand from shippers and consumers.

– Trucking rates increased by 6.8% year-on-year in May 2023, according to DAT Solutions, while rail rates increased by 4.2% year-on-year in April 2023, according to Cass Information Systems.

– Some of the factors driving the demand for inland transportation include the restocking of inventories, the growth of e-commerce and omnichannel retailing, and the diversification of sourcing locations.

– For the week ahead, inland shippers and carriers should watch out for the weather conditions that could affect road and rail operations, such as hurricanes, floods, and wildfires.

- Trends and Insights

– One of the key trends that emerged in the past week was the increasing adoption of digital solutions in the supply chain industry. Several companies announced new initiatives or partnerships to leverage technologies such as artificial intelligence (AI), blockchain, cloud computing, and internet of things (IoT) to improve their visibility, efficiency, resilience, and sustainability.

– For example, Gartner announced its rankings of the Supply Chain Top 15 for Europe on June 11, 2023, highlighting how leading companies such as Unilever, Inditex, Nestle, H&M, and L’Oréal have invested in digital capabilities to enhance their customer-centricity, agility, and innovation.

– Another example was DHL’s relocation of its e-commerce facility to Kansas City on June 9, adding automation features such as two automated parcel sorters that are expected to increase throughput and reduce errors.

– A third example was CH Robinson’s selection of Ford executive Dave Bozeman as its new CEO on June 8, signaling its intention to accelerate its digital transformation strategy that involves using AI and data analytics to optimize its network of over 200,000 carriers.

– These examples show how digital adoption is becoming a necessity rather than a choice for supply chain players who want to stay competitive and relevant in a dynamic and uncertain environment.

The past week was another busy and eventful one for the supply chain industry. The week ahead promises more challenges and opportunities for shippers and carriers who need to adapt to changing customer expectations, market conditions, and regulatory requirements. By using digital solutions and best practices from leading companies, supply chain players can improve their performance and resilience in a complex and volatile world.

- Outlook for Next Week

– Air freight demand is expected to remain strong in June, as e-commerce and vaccine shipments drive the market.

– However, air cargo capacity will likely continue to lag behind demand, resulting in higher rates and longer transit times.

– Sea freight rates are forecasted to stay elevated in June, as peak season demand and port congestion put pressure on the supply chain.

– However, sea freight capacity may improve slightly as more newbuild vessels enter service and carriers deploy extra loaders to cope with demand.

– Inland transportation will face ongoing challenges in meeting demand, as driver shortages and rail congestion persist.

– However, inland transportation may benefit from some relief measures such as increased wages for drivers, new intermodal services at Port Houston and improved infrastructure at major rail hubs.

We have reached the end of this week. We will update constantly latest news, don’t forget to follow our web to receive the latest updates.