RECENT HOT TAKES ON THE FREIGHT MARKET: HEATED FMC FILINGS,CHANGING STORAGE FEES, INTERMODAL SAVINGS & MORE

The Journal of Commerce (JOC) has been continuingly reporting on notable issues relating to the global supply chains scene. Which, for the first week of May article, their devoted SC Writer and Researcher – Cathy Morrow Roberson summarized on slow market issues and rising regulatory filings against carriers that affect contract negotiation of Local 13 of the International Longshore and Warehouse Union (ILWU) and the Pacific Maritime Association (PMA).

To begin with, 2023’s first quarter marked a year of negotiating progress between the 2 parties. The rumor is that a deal was made several weeks ago, in which they agreed on manning needs at the three automated terminals in Southern California. The following Coastwide negotiations in San Francisco will now turn to the two major issues yet to be settled — wages and pension benefits.

- In particular, the number of complaints filed with US Federal Maritime Commission (FMC) has been on the rise.

The most noticable one to mention is from Bed Bath & Beyond asking the FMC to help it win back almost $32 milion it paid to OOCL from 2020 to 2022. BBB’s accusation is that the container line failed to fulfill its service agreements and then gouged the retailer to pay premium prices and peak surcharges during the height of pandemic-related supply chain disruption.

Beside OOCL, Evergreen Marine was also reported of failing to provide contracted vessel space to CertiFit Inc, a Utah-based auto parts buyer. Despite getting paid with $750,000 at higher spot market rates to ensure space on its vessels, EMC only provided 353 TEU out of 1,000 TEU – the minimum quantity commitment (MQC) signed with Shipper. Apart from seeking undisclosed monetary relief, CertiFit is also asking the FMC to ensure Evergreen cannot refuse its contracted cargo in the future.

- Ports and terminals are changing their way of calculating storage fees

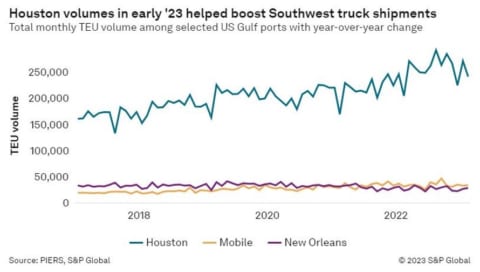

Leading the trend to incentivize cargo flow is The Port of Houston. Starting on May 1st, this port authority will stop charging storage fees beginning May 1 on import containers that stay too long at its marine terminals when their truck gates are closed. On the other hand, a 32% higher per diem fee will be levied upon some boxes to prompt shippers to retrieve them when gates are open.

On the East side, NY-NJ terminals that open on weekends and holidays will be able to use those gate hours as part of their free time calculation under a tariff change taking effect June 1. Under current rules, weekends and holidays are not counterd as part of free time, whether terminals are open or not.

- Shippers’ intermodal savings

Each quarter, the Journal of Commerce (JOC) releases its proprietary Intermodal Savings Index, which combines real data from the intermodal and truckload marketplace with forecasts and more. And the figures for the 1st quarter of 2023 are nearly 26% under annual contracts, which is 4% less than its counterparts in 2022.

The publication also indicated that a shipper on average can benefit at 15% in cost reduction if they choose to intermodal methods amid the race to the bottom between railroads and trucking companies in the past quarter. As rates continue to be pushed down, shippers should also anticipate that savings will increase in the months ahead as more annual contracts are signed.

In comparison, trucking rates were extremely competitive against rail on shorter hauls. This shows as rates for trucking are equal to or even cheaper than rail on many lanes fewer than 1,200 miles. To bounce back, intermodal providers then slashed rates on longer hauls to jockey for market share.

Let’s take a look at the US’s Southwest, the only region in the country where truck volumes and shipper spending on truck freight both increased for the eighth straight quarter. It is the result of the sky-rocketed US trade with Mexico. For this year’s 1st quarter alone, truck freight volume in the Southwest rose 5% sequentially, and 14% year over year. Nationally, on the contrary, double-digit year-over-year declines in volumes were reported by the U.S. Bank. across most of the remaining regions.

4. Standards & Lawsuit

The last 2 heated cases to be covered in this article are respectfully the Scheduling Standards Consortium (SSC) launched in Dec by J. B. Hunt, Uber Freight and Convoy; and the freight broker’s lawsuit against DAT Freight & Analytics.

Scheduling Standards Consortium (Ssc) aims to change fragmented supply chain.

With this coalition, the above collaborators intended to build a common appointment scheduling protocol on application programming interfaces (APIs) to resolve a long-standing area of friction between shippers and carriers.

To start, SSC’s “initial documentation and system interaction model” will be released in the 2nd quarter, with its technical standard and API design completed and implemented in at least one transportation management system by the end of 2023.

Convoy’s countersuit to DAT Freight & Analytics’ original lawsuit against Convoy for breach of contract in 2022

By and large, the legal battle between 2 parties is leaning towards Convoy procedural win, as DAT’s allegation (Convoy building a competitive load board while a customer of DAT) is overshadowed by DAT’s alleged monopolistic pricing behavior.

Many of DAT’s claims will need to try again. Meanwhile, all of Convoy’s counterclaims survived, which means that DAT will need to answer the various counterclaims Convoy made, said the transportation attorney Matthew Lefler.

Reported by SUVI @WEDO 2023-06-06