Shanghai- China’s largest city, is a major financial center and crucial port as well as a hub for manufacturing electronics and cars. Currently, the city has been on lockdown due to a new wave of Covid-19. Chinese authorities sought to reassure companies and jittery investors. Don’t be misled by purportedly targeted ‘zero-COVID’ measures.

The expansion of zero-COVID restrictions in Shanghai needs to be monitored closely.

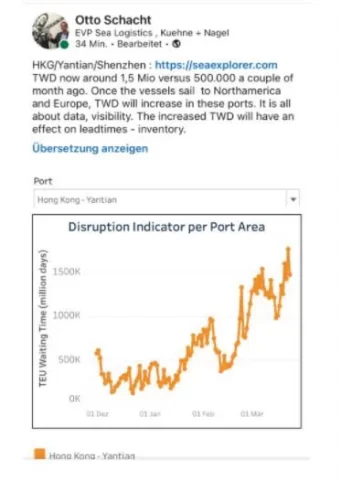

The latest disruption indicators show that regardless of how targeted a “zero-COVID” measure is in China, there are impacts on the flow of both domestic and global trade. The latest disruption indicator from Kuehne + Nagel dismisses the downplaying bluster and the claims that the Yantian port was “operating normally.”

Port productivity hinges more on vessels. Otto Schacht, EVP of sea logistics at Kuehne + Nagel, shares with American Shipper the disruption he posted on his LinkedIn post “is the effect of the partial lockdown in southern China due to COVID, factories closed for a week, terminals, less cargo, etc.”

Otto Schacht posted on his LinkedIn.

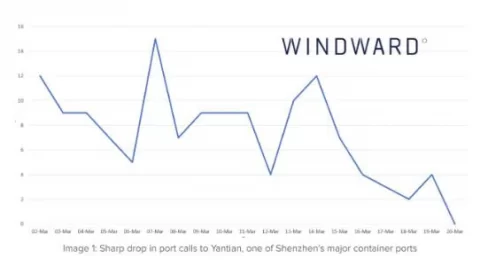

Windward published similar disruption data, indicating a decrease of 84% in the volume of container processing at the Port of Yantian.

Sharp drop in port calls to Yantian-one of Shenzhen’s major container ports.

Containers don’t lie.

According to HLS Holding’s newest notice to its clients, “The result of the disruption in Shenzhen and Shanghai is impacting container turnaround. … CMA equipment shortage is now deteriorating at many origin ports, so CMA likes to push more SOC business from Shanghai and Ningbo to PSW. … Once the lockdown in China is lifted, the huge backlog of delayed containers will fill the vessels and make space tight again.”

The logistics corporation also warned that due to the restricted trucking services and labor shortages, as a result, shippers should be bracing for “skyrocketing haulage costs.”

But the most alarming was its update on Shanghai.

“Shanghai: The lockdown area has been further extended with dynamic changes. The city is organizing massive nucleic acid testing, and COVID test reports valid for 48 hours are widely obligated for almost all public activities.”

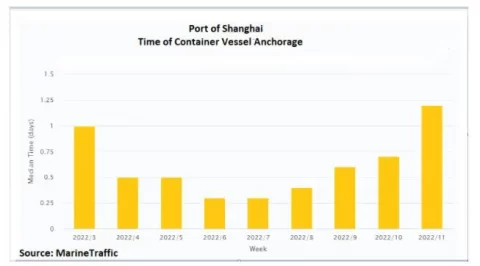

According to MarineTraffic, there is an uptick in anchorage time off the port. This is caused by the reduction in the workforce.

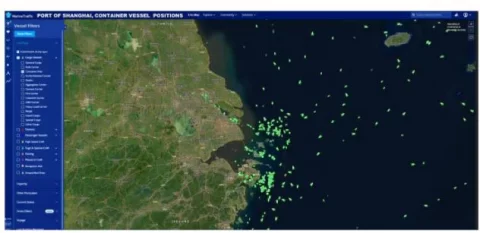

MarineTraffic tells American Shipper that the proportion of box ships waiting off port limits (OPL) outside Shanghai has increased. As of 24 March, 57 vessels are waiting outside port limits, whereas two weeks ago there were just 27 container ships.

“In just a month, over 100,000 additional containers capacity is strung waiting outside Shanghai,” tells Alex Charvalias, supply chain in-transit visibility lead at MarineTraffic. “We also see a number of bulk carriers waiting outside the port too.”

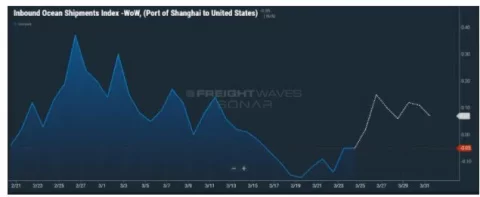

While the drop in container volume post-Chinese New Year may be over, you can see the hiccups these restrictions are presently having.

If the disruption indicators show how a targeted one-week quarantine in Shenzhen impacted the Port of Yantian, the increase of restrictions in Shanghai needs to be monitored closely. The region is in its second week of targeted restrictions and Shanghai is the busiest container port in the world. Don’t let the rhetoric of “normal ocean terminal operations’” blindside you. The “zero-COVID” bubble at the port may be intact since you have workers living there. Outside of that bubble, you have an iron fist choking trade.

Source: American Shipper